Cryptocurrency has become very popular, capturing the interest of many people around the world. It started as something only a few people knew about, but now, it’s a big part of the financial world. As more people use and invest in digital money, it’s important to understand how it works. One exciting part of cryptocurrency is called crypto airdrops.

A crypto airdrop is when free digital tokens are given to many people. Companies do this to promote a new cryptocurrency and get people interested. Getting these free tokens can be a nice surprise for many. But, it’s not as simple as it sounds. There are tax rules that people need to know about when they receive these tokens.

Different countries have different tax laws for crypto airdrops, making it confusing for many. Some people might not even realize they need to pay taxes on the tokens they receive. This article will help explain when and how these free tokens are taxed. It will look at the rules in different places, discuss when airdrops are taxable, and advise on how to report them on tax forms.

By understanding these tax rules, people can avoid problems and make sure they follow the law. Knowing whether crypto airdrops are taxable is important for anyone involved with digital money.

This guide will help make sense of the rules and help people manage their cryptocurrency better.

The Rise of Cryptocurrency and Airdrops

In the last ten years, cryptocurrency has become very popular. It all started with Bitcoin in 2009, and now there are thousands of different digital coins and tokens. Many people are excited about cryptocurrency because it promises a new way to handle money without needing banks, and it offers a chance to make a lot of money. More and more businesses are also starting to use the technology behind cryptocurrencies, called blockchain.

One key way that new cryptocurrencies spread is through airdrops. An airdrop is when a company gives away free digital tokens to many people. This helps them get the word out about their new cryptocurrency and attract users. It’s a bit like handing out free samples at a store to get people to try a new product. When people get free tokens, they become interested in the project and may start using it and telling others about it.

One famous example of an airdrop is from Uniswap, a platform where people can trade cryptocurrencies. In September 2020, Uniswap gave away 400 UNI tokens to each user who had used their platform before. This made a lot of people happy and got a lot of attention.

Another example is Stellar, which gave away many XLM tokens to promote its currency. Stellar worked with different wallet providers to give away millions worth of tokens. This helped make more people aware of Stellar and increased the use of its tokens.

In conclusion, the rise of cryptocurrency and using airdrops have changed the digital finance world. By understanding how airdrops work, people can better navigate the world of cryptocurrency and make smart choices about participating in these new markets.

The Legal and Tax Landscape

As cryptocurrency continues to gain traction globally, tax authorities and governments are working to keep pace with the evolving landscape. Understanding how these authorities view and tax cryptocurrencies, particularly airdrops, is essential for anyone involved in the crypto market. check our article on Understanding the legal landscape of Crypto Airdrops

Global Perspectives on Cryptocurrency

Cryptocurrencies are viewed differently across the world. In the United States, the Internal Revenue Service (IRS) treats cryptocurrencies as property. This means that general tax principles applicable to property transactions also apply to transactions involving cryptocurrency. Every event, from buying and selling to receiving payments and earning through mining, is a taxable event.

In the United Kingdom, Her Majesty’s Revenue and Customs (HMRC) also considers cryptocurrency as property. Taxation depends on whether the individual is trading or investing in cryptocurrencies. Investors are subject to Capital Gains Tax (CGT), while traders may be subject to Income Tax.

Other countries have varied stances. For instance, in Germany, cryptocurrencies held for more than a year are tax-free, whereas in Japan, cryptocurrency transactions are taxed as miscellaneous income. These differences highlight the need for crypto users to stay informed about the regulations in their respective countries.

Check out our article to know more about how airdrops are taxed, especially in North America!

Taxable Events in Cryptocurrency

Tax authorities have outlined specific taxable events related to cryptocurrency. These include:

- Receiving cryptocurrency as income or through airdrops: This is considered ordinary income and is taxable at the fair market value at the time of receipt.

- Trading cryptocurrency: Any gains or losses from trading one cryptocurrency for another are taxable.

- Selling cryptocurrency: Similar to trading, selling cryptocurrency for fiat currency (like USD or EUR) triggers a taxable event.

- Using cryptocurrency to purchase goods or services: The use of cryptocurrency for transactions is also a taxable event.

Airdrops, a method of distributing cryptocurrency tokens to multiple wallet addresses, fall under these taxable events, often triggering tax liabilities at the time of receipt.

- Taxation of Crypto Airdrops

When it comes to airdrops, tax authorities like the IRS have provided some guidance. According to IRS Notice 2014-21 and subsequent updates, airdrops are considered income and are taxable upon receipt. The fair market value of the tokens at the time they are received must be reported as ordinary income. This applies regardless of whether the recipient immediately sells the tokens or holds them.

Similarly, HMRC in the UK considers the receipt of airdrops as taxable income. The value of the airdropped tokens must be included in the recipient’s taxable income for that year. Subsequent gains or losses from holding or disposing of these tokens are subject to Capital Gains Tax.

Evolving Regulations and Future Outlook

The legal landscape for cryptocurrency and airdrops is constantly evolving. Tax authorities around the world are continually updating their guidelines to address new developments in the crypto space. For instance, the IRS has increased its focus on cryptocurrency, including adding a question about virtual currency transactions on the first page of the tax return form (Form 1040).

Future regulations may provide more clarity or impose stricter reporting requirements. As the cryptocurrency market matures, more countries will likely establish comprehensive tax frameworks to address the complexities of digital assets.

Staying informed about these changes is crucial for crypto users. Consulting with tax professionals and leveraging crypto tax software can help ensure compliance with the current regulations and prepare for any future changes.

Additionally, the legal and tax landscape for cryptocurrency, particularly airdrops, is complex and varies significantly by country. Understanding these nuances and staying updated with evolving regulations is essential for managing tax liabilities effectively.

Are Crypto Airdrops Taxable?

Crypto airdrops have become a common method for blockchain projects to distribute tokens to a large number of cryptocurrency holders. However, the tax treatment of these airdrops varies by jurisdiction and can be complex. Here, we’ll explore the tax implications of receiving crypto airdrops, focusing primarily on the U.S. tax system, with some references to other countries’ approaches.

Taxability of Airdrops upon Receipt

In the United States, the Internal Revenue Service (IRS) treats cryptocurrency as property for tax purposes. According to IRS guidelines, crypto airdrops are taxable as ordinary income at the fair market value on the date of receipt. This means that if you receive an airdrop, you must report its value as part of your gross income. The fair market value is typically determined by the trading price of the tokens on the date they are received.

For example, if you receive 100 tokens via an airdrop and the fair market value of each token is $10 at the time of receipt, you must report $1,000 as income. This income is subject to the same tax rates as your regular income, which could be anywhere from 10% to 37% depending on your total income and tax bracket.

Valuation and Timing Issues

One of the main challenges with airdrop taxation is determining the exact fair market value and timing. Cryptocurrencies can be highly volatile, and the value of tokens can fluctuate significantly within a short period. The IRS requires that the value be recorded at the time you gain dominion and control over the airdropped tokens, meaning when you can transfer, sell, or exchange them.

This can lead to practical difficulties. For instance, if you receive an airdrop but are unaware of it for several days, you might have to determine the token’s value retrospectively on the date you gained control. Accurate record-keeping is crucial to ensure compliance and avoid potential penalties.

Case Studies and Examples

To illustrate, let’s consider two scenarios:

- Immediate Awareness and Control: You receive 50 tokens in an airdrop on July 1st. You check your wallet the same day and see the tokens. On July 1st, each token is worth $5. You must report $250 ($5 x 50 tokens) as income.

- Delayed Awareness: You receive 100 tokens in an airdrop on July 1st but only check your wallet on July 10th. The IRS would expect you to use the token value on July 1st, assuming you had control over them from that date. If the tokens were worth $3 each on July 1st, you would report $300 ($3 x 100 tokens) as income, even if the value changed by the time you became aware.

Tax Implications of Selling Airdropped Tokens

Once you have reported the airdrop as income, any subsequent sale or exchange of these tokens will trigger a capital gains tax event. The basis (initial value) of the tokens is their fair market value when you receive them. If you sell the tokens at a higher price than the basis, you incur a capital gain; if you sell them for less, you incur a capital loss.

For instance, if you sell the 50 tokens mentioned earlier (with a basis of $5 each) for $8 each, you will realize a capital gain of $3 per token. The nature of the capital gain (short-term or long-term) depends on the holding period. If you held the tokens for more than a year before selling, the gains are long-term and generally taxed at a lower rate.

International Perspectives

Other countries have varied approaches to airdrop taxation. In the UK, for instance, HM Revenue and Customs (HMRC) treats airdrops received without doing anything in return (such as promotional airdrops) as taxable income. The specifics, however, depend on individual circumstances and the nature of the airdrop. Some countries may not yet have clear guidelines, making it essential for taxpayers to consult with tax professionals familiar with cryptocurrency regulations in their jurisdiction.

In summary, crypto airdrops are generally taxable as ordinary income upon receipt, with the value determined by the fair market price at that time. Accurate reporting and record-keeping are crucial to meet tax obligations and avoid penalties. As regulations continue to evolve, staying informed and consulting with tax professionals can help navigate the complexities of airdrop taxation.

How to Report Airdrops on Taxes

Reporting airdrops on taxes is crucial for compliance with tax regulations, especially as cryptocurrency activities come under increasing scrutiny. Airdrops are generally considered taxable events, and the value of the tokens or coins received is treated as income at the time of receipt.

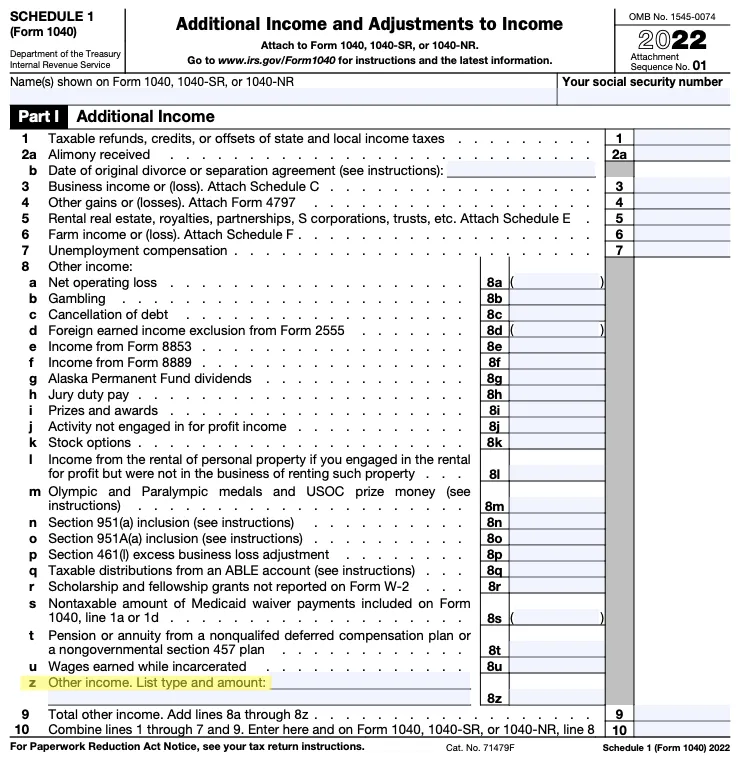

For U.S. taxpayers, this income should be reported on IRS Form 1040 Schedule 1 under “Other income” on line 8. Proper documentation and accurate reporting are essential to avoid penalties and ensure compliance with tax laws.

Step-by-Step Guide on Reporting Airdrops on Tax Returns

- Understand Taxable Events: Airdrops occur when cryptocurrency tokens or coins are distributed to individuals’ wallets without any payment or exchange of value. From a tax perspective, airdrops are generally treated as taxable events because they represent an increase in wealth or income for the recipient.

- Initial Valuation: When you receive an airdrop, you need to determine the fair market value (FMV) of the tokens or coins at the time of receipt. This value is crucial because it establishes the amount of income you must report on your tax return. FMV can often be determined from cryptocurrency exchanges or other reputable sources that provide pricing information at the time of the airdrop.

- Reporting as Income: The FMV of the airdropped tokens should be reported as income on your tax return for the year in which you received them. On IRS Form 1040 Schedule 1, you would enter this income under “Other income” on line 8. This ensures that your total income for the year accurately reflects all taxable events, including cryptocurrency-related income like airdrops.

- Keeping Records: Documentation is critical for accurately reporting airdrops and complying with tax regulations. Keep records that include:

- Date of Receipt: Note the exact date when you received the airdrop.

- Fair Market Value: Document the FMV of the tokens or coins at the time of receipt.

- Subsequent Transactions: Record any transactions involving the airdropped tokens, such as trades, transfers to other wallets, or sales. These records help calculate gains or losses when you dispose of the tokens in the future.

Importance of Documentation and How to Maintain Records

- Evidence for Tax Filings: Proper documentation serves as evidence to support the accuracy of your tax filings. It demonstrates that you have reported your cryptocurrency income, including airdrops, correctly and can justify the valuation used.

- Audit Trail: In case of IRS inquiries or audits, detailed records help you explain the origin and value of airdropped tokens. This reduces the risk of penalties and ensures compliance with tax laws.

- Tracking Changes in Value: By documenting the fair market value (FMV) of airdropped tokens at the time of receipt and tracking subsequent transactions, you can calculate capital gains or losses accurately when you dispose of the tokens. This is crucial for reporting gains or claiming losses on your tax return.

Tools and Resources for Tracking and Reporting

- Crypto Tax Software: Dedicated platforms such as CoinTracking, CryptoTrader.Tax, and Bitcoin. Tax automate the calculation of taxable events, including airdrops. They integrate with cryptocurrency exchanges and wallets to import transaction data, calculate gains and losses, and generate tax reports compliant with IRS guidelines.

- Spreadsheets: Excel or Google Sheets can be used for manual tracking and reporting. Create custom templates to record details of airdrops, including dates, FMV at receipt, and subsequent transactions. While more labour-intensive, spreadsheets provide flexibility and customization options for tracking cryptocurrency activities.

Potential Penalties for Non-Compliance

- IRS Scrutiny: The IRS has prioritized cryptocurrency tax compliance and increasingly audits taxpayers with cryptocurrency transactions, including airdrops. Failure to report airdrops as income can trigger an audit and result in penalties and interest on unpaid taxes.

- Penalty Structure: Penalties for underreporting income or failing to file accurate tax returns can vary. They may include substantial fines, interest on unpaid taxes, and even criminal charges for deliberate tax evasion in severe cases.

- Avoiding Penalties: To minimize the risk of penalties:

- Accurate Reporting: Ensure all cryptocurrency income, including airdrops, is reported on your tax return as required.

- Use Reliable Tools: Employ reputable crypto tax software or consult with a tax professional to navigate complex tax regulations accurately.

- Maintain Detailed Records: Keep thorough records of all cryptocurrency transactions, from airdrops to trades and disposals. Documentation should include dates, transaction amounts, FMV at each transaction, and details of counterparties involved.

- File Timely and Correctly: Submit your tax returns on time and ensure they accurately reflect your cryptocurrency activities. Timely filing reduces the likelihood of penalties and IRS scrutiny.

By understanding the importance of documentation, leveraging appropriate tools for tracking and reporting, and complying with tax regulations, you can manage your cryptocurrency tax obligations effectively. Proactive compliance minimizes the risk of penalties and ensures your tax filings accurately reflect your financial activities involving cryptocurrencies.

Conclusion

Understanding how crypto airdrops are taxed is essential for complying with tax laws and avoiding potential penalties. Airdrops are considered taxable events, and their fair market value (FMV) at the time of receipt must be reported as income on IRS Form 1040 Schedule 1, specifically under “Other income” on line 8.

Proper documentation, including the date of receipt, FMV, and subsequent transactions, is crucial for accurate reporting. Tools like crypto tax software can simplify this process. Non-compliance can result in penalties and increased IRS scrutiny.

By maintaining detailed records and using reliable reporting tools, you can ensure your tax filings are accurate and complete, helping you meet your tax obligations while minimizing the risk of penalties.