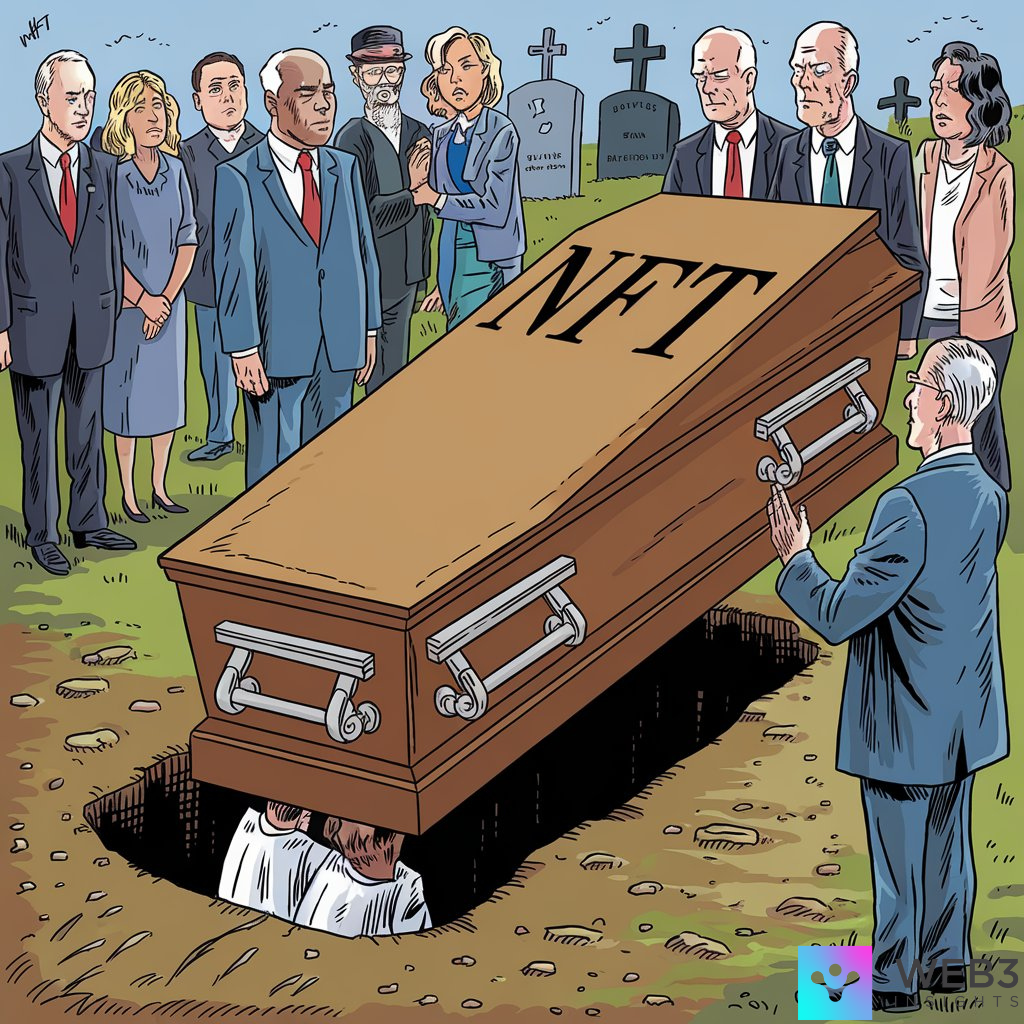

Back in 2021, NFTs were everywhere! From celebrities to everyday people, it felt like everyone was talking about Non-Fungible Tokens. But recently, the noise has quieted. So, the question on everyone’s mind is: are NFTs dead? Have they lost their value, or is there more beneath the surface?

Although NFT trading has slowed down from its peak, major crypto platforms like Binance, Kraken, and Coinbase are still heavily invested in the NFT space. This hints that the future may not be as grim as some predict.

In this article, we’ll examine what drove the initial NFT craze, why the excitement faded, and whether they have a future.

Stay tuned!

The Rise of NFTs (The 2021 Boom)

In 2021, NFTs surged in popularity. A mix of celebrity involvement, innovation in digital art, and speculative trading drove this. Artists used them to sell their work directly to fans, while collectors saw an opportunity to make quick profits by flipping them.

The market peaked with high-profile sales, such as Beeple’s digital artwork that sold for $69 million, pushing NFTs into the spotlight. Celebrities like Paris Hilton shared their new Bored Ape NFTs, and news outlets proclaimed them the next big thing in art.

But what made NFTs so appealing in the first place?

- Verifiable Ownership: NFTs allow buyers to prove ownership of unique digital assets, using blockchain technology for transparency and authenticity.

- Digital Scarcity: Just like rare physical art or collectables, NFTs offered exclusivity. Limited editions and one-of-a-kind items made them highly desirable.

- Investment Potential: Early adopters saw NFTs as a way to make quick profits, with stories of skyrocketing prices fueling speculative buying and selling.

- Community Access: Owning certain NFTs unlocked membership to exclusive communities, events, and perks, offering a sense of belonging and status.

- Digital Identity: NFTs allow people to showcase their identity in the digital world, whether through art, virtual items, or being part of an exclusive club.

The Crash: Declining Interest and Market Value

By April 2024, it was pretty clear that the NFT craze had cooled off a lot. Back in 2021, everyone was rushing into NFTs, hoping to make a quick buck rather than appreciating the value of the NFTs themselves.

NFTs are closely tied to the performance of cryptocurrencies, especially Ethereum. So, when the crypto market took a hit, it also affected how much people were willing to spend on NFTs. And with the decline of virtual worlds like the metaverse, interest in digital tokens dropped even further.

A lot of NFTs that were bought at sky-high prices in 2021 are now worth just a fraction of what they once were. Some reports even say they have lost almost all their value.

Here’s why:

1. Oversupply of NFTs

The initial excitement around non-fungible tokens led to a massive influx of new projects, and before long, the market was flooded with digital assets. With thousands of it being created every day, it became overwhelming to sift through and find the truly valuable ones. This glut of new NFTs made it harder for high-quality projects to stand out, causing many investors to feel burnt out and disillusioned.

2. End of the Hype Cycle

The early buzz around NFTs drove prices up and sparked a frenzy of speculative trading, similar to what happens in other market bubbles. People were buying NFTs with the hope that their value would keep skyrocketing. But as with most bubbles, the excitement eventually wore off. When the initial hype died down, reality set in, and the market had to correct itself.

3. Intellectual Property Issues

The NFT space has faced significant challenges related to intellectual property. There have been numerous cases of copyright infringement and unauthorized use of creative works. For instance, some NFT creators have used art or content without permission, leading to legal disputes and backlash from original creators. With the lack of clear protections and frequent legal battles, many are wary of participating in a market that feels unreliable and contentious.

4. Fraudulent Projects and Scams

Scams and fraudulent schemes have been a huge problem in the NFT space. From fake projects that disappear with investors’ money (often called ‘rug pulls’) to misleading offers, these scams have seriously eroded trust in the NFT ecosystem. As these issues became more prevalent, many people became cautious about investing in NFTs, fearing they might be the next victim of a scam.

So, while they were all the rage a few years ago, it’s clear that the bubble has burst. Now, we’re seeing a more measured approach to this digital phenomenon.

Conclusion: So Are Nfts Dead?

Not at all. Sure, the buzz around flashy profile pictures has faded, but the core technology behind NFTs is still going strong. They’re changing how we think about ownership, building new communities, and even making a positive impact in various ways.

Of course, there are still hurdles to overcome, like environmental concerns and regulatory issues. But the future of NFTs isn’t just about pricey digital monkeys. It’s about unlocking endless possibilities like enabling creators, businesses, and individuals to connect, innovate, and make a difference in the digital realm.

The NFT world is evolving. New projects are popping up, and they are branching out beyond art into areas like event tickets, data ownership, and gaming. As technology advances and we adapt to the digital age, NFTs are set to become a bigger part of how we shape art, commerce, and culture.